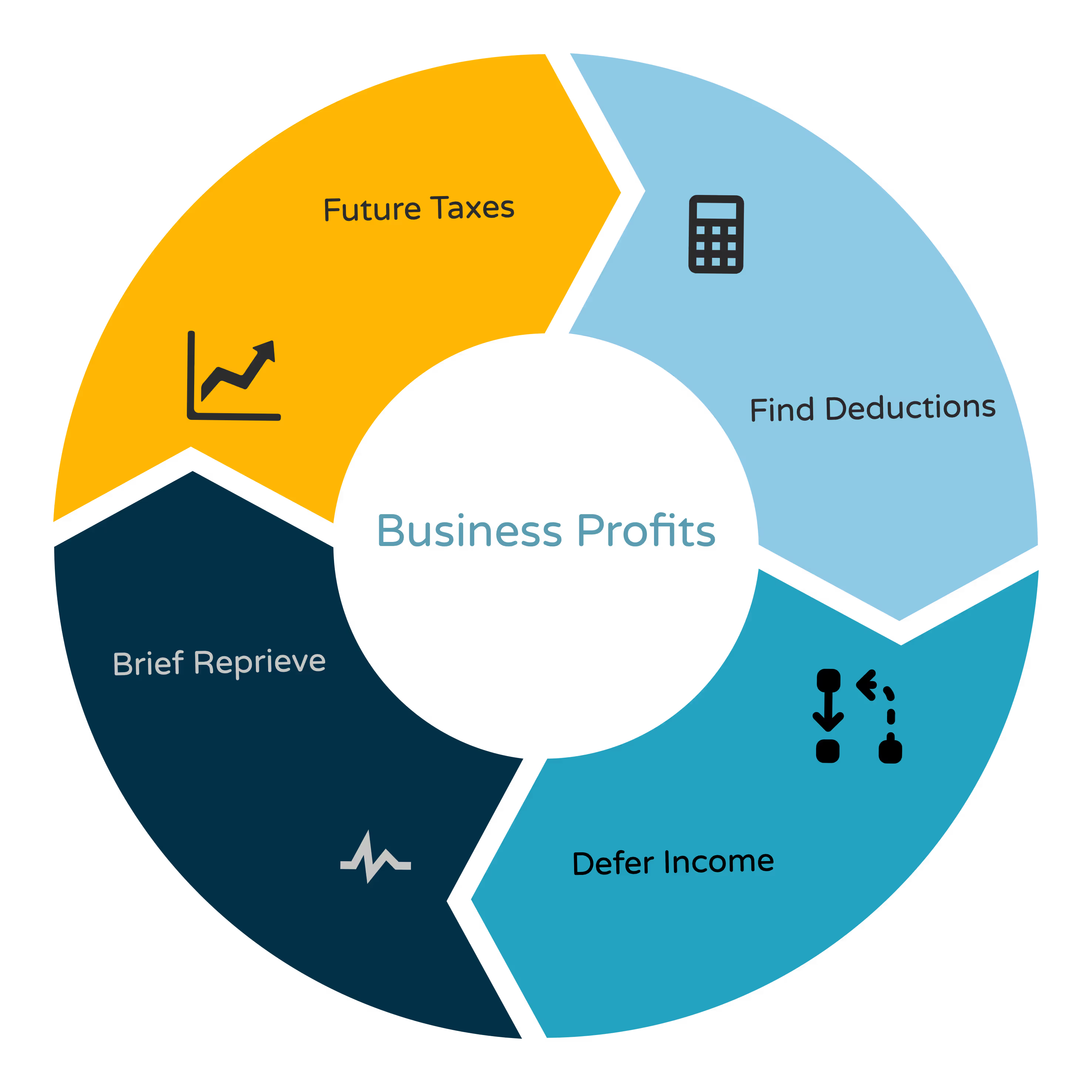

Most business owners are stuck in the same deferral loop: spend more to chase deductions, push income into the future, then repeat the cycle next year with an even bigger tax problem. Deductions and deferrals are ineffective and limited.

The Tax Protection Plan™ breaks that pattern by first securing every reasonable deduction you deserve, then shifting the focus to truly tax‑efficient strategies instead of endless postponement. Instead of trying to outrun your tax bill, you get a proactive, long‑term plan that aligns with how your business is actually growing.

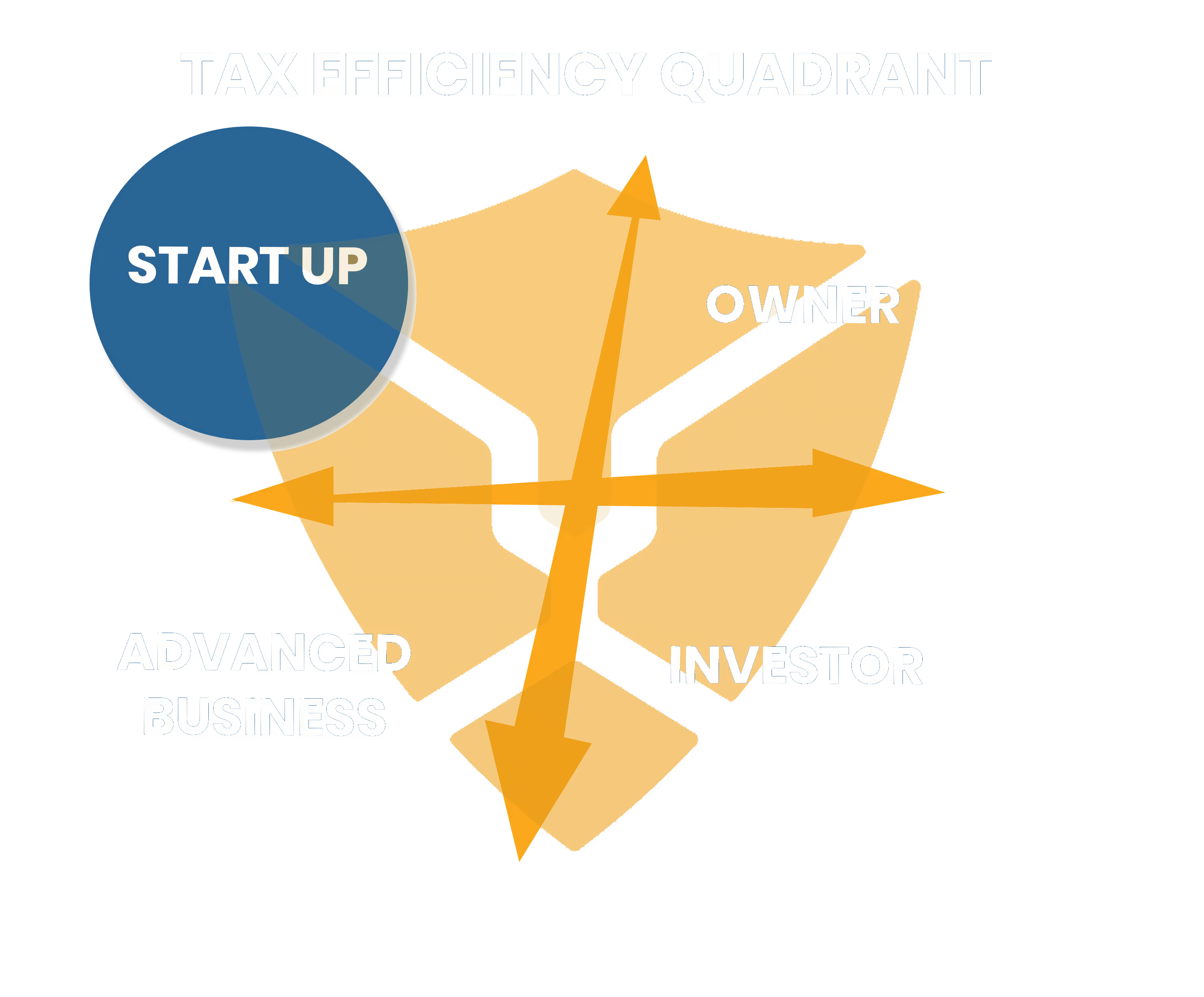

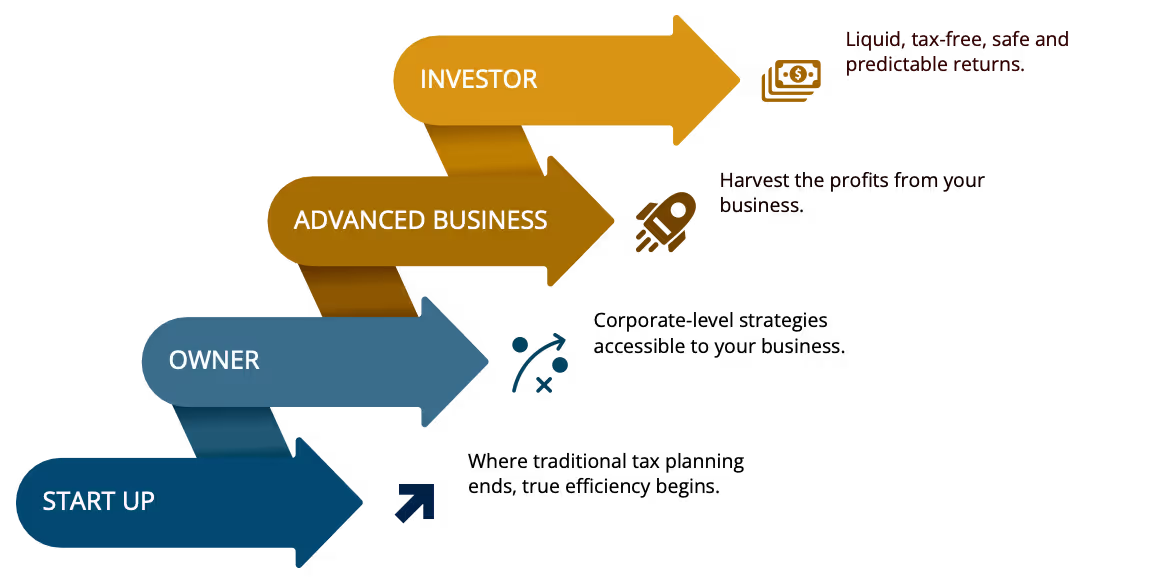

“Start Up” isn’t about how long you’ve been in business—it’s about the level of tax strategy you’re using. Most established businesses are still treated like start ups: heavy on deductions and deferrals, light on real tax‑efficient planning.

If your main moves are “find more expenses” and “push income into the future,” you’re in the Start Up Quadrant, no matter how successful you are. The Tax Protection Plan™ exists to move long‑standing businesses beyond those basic tools into more advanced, tax‑efficient opportunities.

We start where conventional tax planning ends, recognizing that growing businesses need sophisticated strategies that scale with success.

Our specialized team brings advanced knowledge typically reserved for large corporations, making it accessible and applicable to your growing business.

Experience the difference between temporary tax deferral and genuine tax efficiency with strategies that deliver quantifiable improvements year after year.

“The tax law is written primarily to reduce your taxes. 99.5% of the tax code exists solely for the purpose of saving you money.” ~Tom Wheelright

Your free tax strategy consultation awaits.

Our tax strategy experts will analyze your specific situation and identify opportunities most accountants miss.